Five years ago, short-term rental (STR) investing felt like the Wild West. Hosts were testing the waters, juggling personal income verification, and hoping for the best on platforms like Airbnb and Vrbo. But today? The game has changed—and for serious investors, that’s great news.

The market has matured. We’re seeing more data, clearer guest behavior patterns, and better financial products tailored specifically for STRs. The result: a steadier, more predictable revenue landscape that makes financing easier and scaling smarter.

If you’ve been waiting for the right time or the right strategy to jump in or expand, this is your moment.

The Power of Predictability in STR Investing

At its core, STR success today is about understanding and leveraging one key metric: Gross Rental Yield.

Gross Rental Yield = (Annual STR Revenue ÷ Median Home Price) × 100

Why does this matter? Because it tells you how much rental income you’re generating for every dollar you invest in a property.

Example:

- Median home price: $300,000

- Annual STR revenue: $45,000

- Gross Rental Yield = (45,000 ÷ 300,000) × 100 = 15%

That’s a solid number—especially when compared to long-term rental yields or traditional investment properties. And in today’s data-backed environment, we can actually target markets that consistently deliver returns like this.

Top 5 STR Markets to Watch in 2025

Data provided by AirDNA, Zillow, and Host Financial

These five cities aren't just hot spots—they’re markets with the right combination of affordability, demand, and revenue potential.

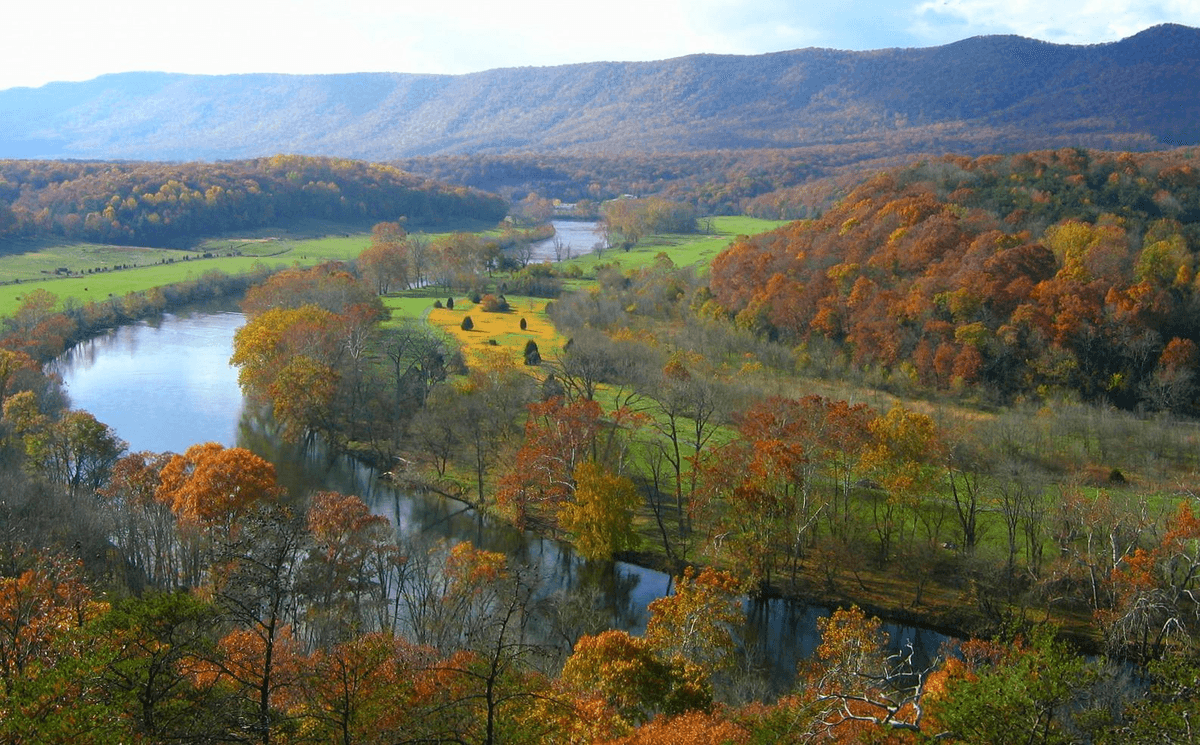

1. Shenandoah, Virginia

- Market score: 94

- Annual revenue: $42K

- ADR: $266.51

- RevPAR: $128.94

- Average home price: $255,593

- Yield: 16.4%

Shenandoah remains a hidden gem, driven by nature lovers visiting Shenandoah National Park. High nightly rates and low home prices make it a strong value play.

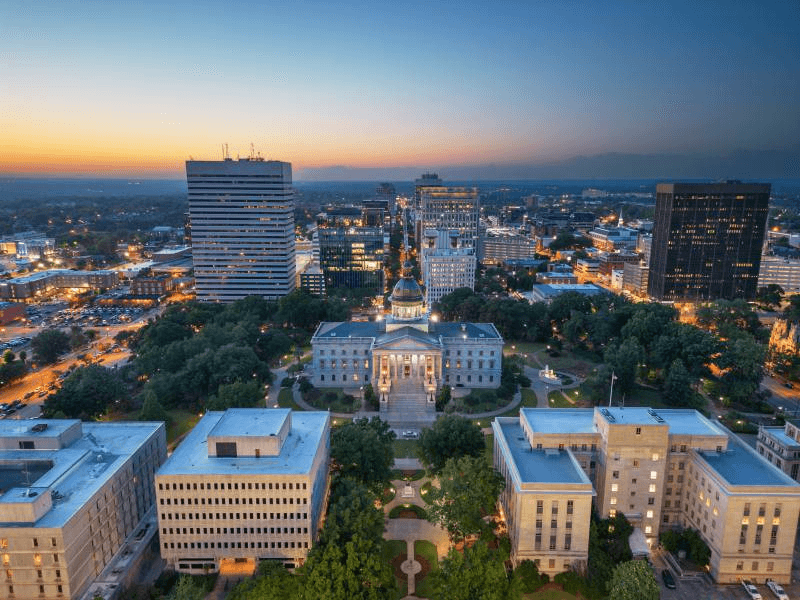

2. Columbia, South Carolina

- Market score: 98

- Annual revenue: $33.9K

- ADR: $201.50

- Occupancy: 57%

- Average home price: $232,153

- Yield: 14.6%

College town. State capital. Business hub. Columbia ticks every box for reliable demand, with high growth potential and strong occupancy.

3. Poconos, Pennsylvania

- Market score: 60

- Annual revenue: $53.2K

- ADR: $394.14

- RevPAR: $164.27

- Average home price: $246,669

- Yield: 21.5%

A staple for family vacations and group getaways, the Poconos combines luxury pricing with big-house potential. Think hot tubs, pool tables, and strong seasonality.

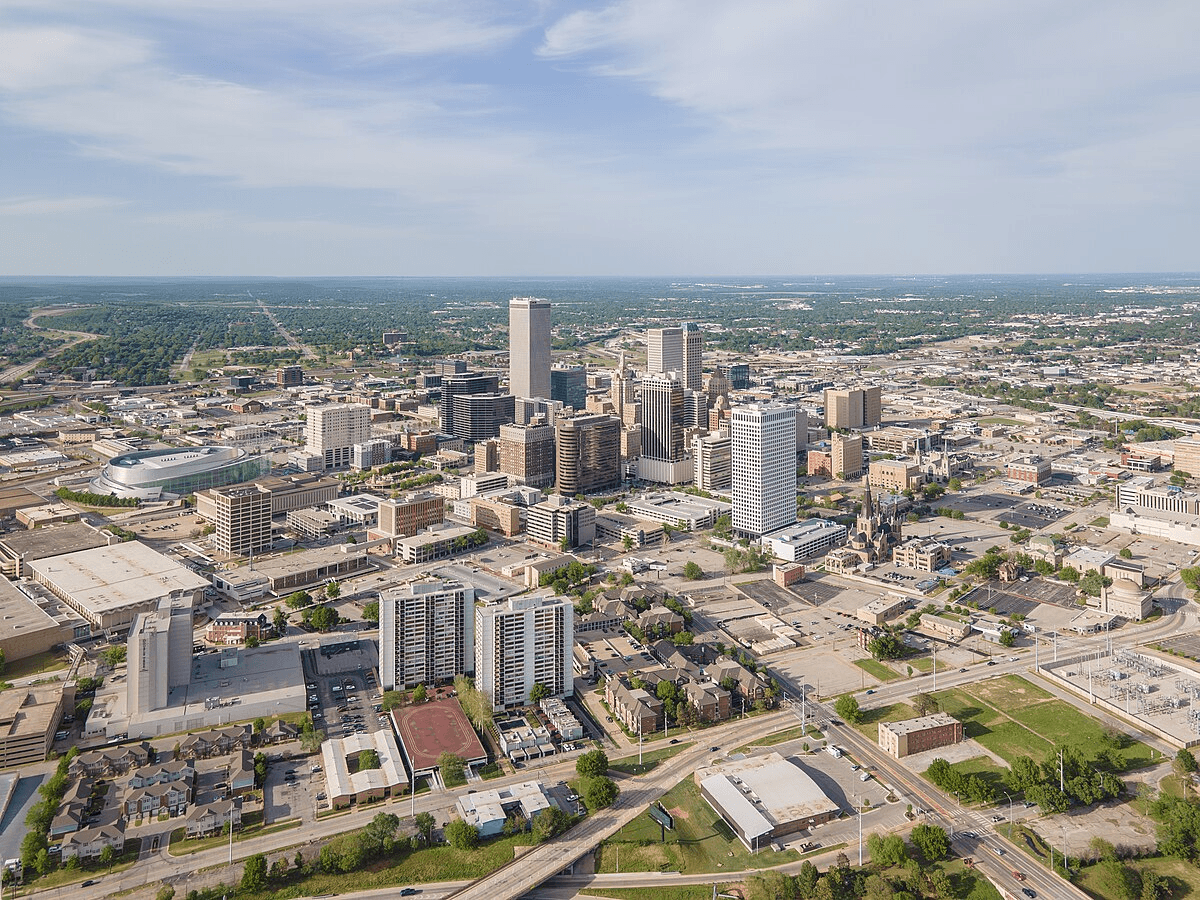

4. Tulsa, Oklahoma

- Market score: 99

- Annual revenue: $28.3K

- ADR: $173.92

- RevPAR: $95.42

- Average home price: $205,014

- Yield: 13.8%

Tulsa keeps climbing the ranks thanks to a vibrant arts scene and growing tourism. It's ideal for budget-conscious investors looking for urban STR upside.

5. Destin, Florida

- Market score: 91

- Annual revenue: $72.2K

- ADR: $395.52

- RevPAR: $245.60

- Average home price: $577,366

- Yield: 12.5%

Destin is a top-tier beach destination that commands luxury rates. Revenue growth is strong, and the average return remains impressive despite the higher price tag.

Tips for Succeeding in the New STR Era

- Get Prequalified First

Don’t shop blind. Knowing your loan ceiling—and the loan types that fit your strategy—lets you act fast and negotiate better. - Understand Zoning & Permits

Not all markets welcome STRs equally. Before you buy, make sure you know the local rules—and work with a lender who does too. - Design With Guests in Mind

The difference between good and great ADRs? Design. Think functionality, uniqueness, and high-end touches that photograph well. - Build a Local Team

Cleaners, property managers, handymen, permitting pros—this crew is your operational backbone.

Final Thoughts: Scale Smarter, Invest With Confidence

Short-term rental investing isn’t just more mature—it’s more strategic. With predictable income, stronger data, and specialized financing, today’s investors have the chance to build scalable portfolios in markets that actually make sense.

These five cities represent where performance and opportunity align—but your next move is about more than numbers. It’s about working with experts who understand STR investing from the inside out.

That’s what we do at Florida Property Group.

If you’re ready to get prequalified, review STR-focused listings, or simply talk strategy—we’re here to help you buy smarter, scale faster, and invest with clarity.

👉 Join our private investor network today.